Assess Your Buying Power Before Purchasing a Second-Hand Home

A Smart Financial Planning Guide Before Applying for a Mortgage

Buying a second-hand property is not just about choosing the right house—it starts with understanding your true financial capacity. If you plan to finance the purchase through a bank loan, assessing affordability is the most critical first step.

Bank Mortgage Approval Criteria

Banks typically approve loans for borrowers who:

Have stable, regular income

Carry manageable debt obligations

Maintain a good credit record

Key conditions include:

Loan amount: up to 90–95% of appraised value

Monthly installment: not exceeding 30% of monthly income

Loan tenure: borrower’s age + loan period ≤ 65 years

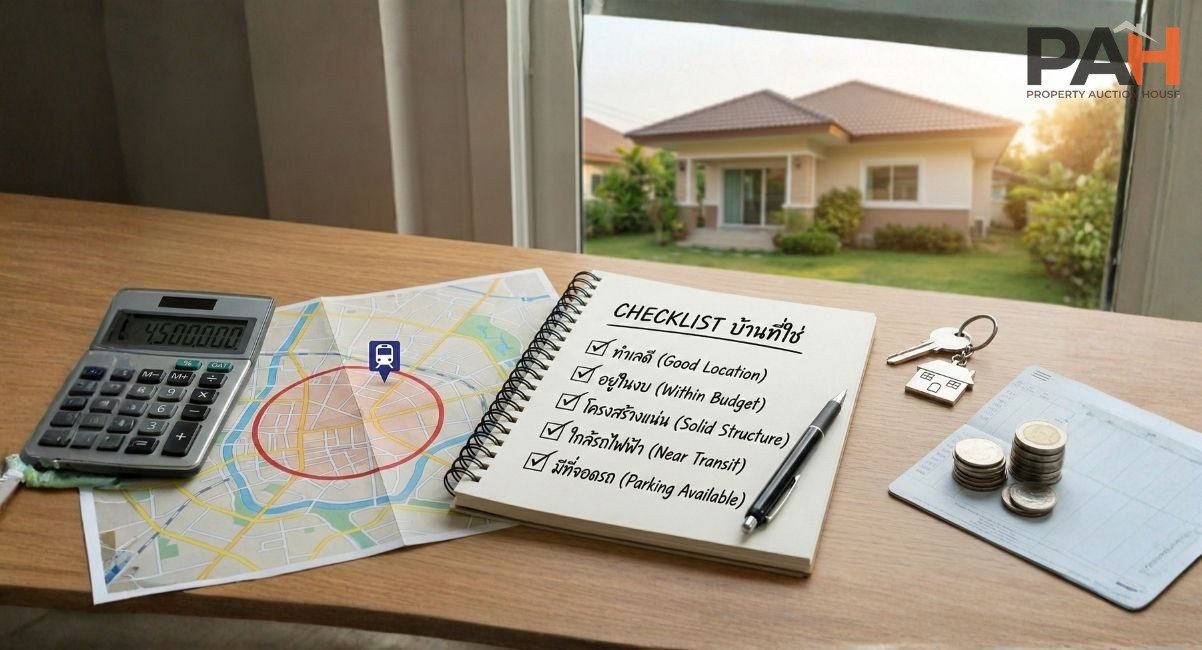

Why Second-Hand Homes Win on Location

Second-hand homes often sit in:

Established residential areas

City centers and economic zones

Locations where new developments are no longer possible

This makes them highly desirable and valuable in the long term.

FAQ

Q: Can I get a mortgage for a second-hand property?

A: Yes. Banks assess second-hand homes similarly to new properties if documentation is complete.

Q: How much should I earn to qualify?

A: Your monthly repayment should not exceed 30% of your net income.