What Is Auction Property Investment?

Auction property investment refers to purchasing real estate sold through a legal enforcement or foreclosure auction process.

In Thailand, most auction properties come from court enforcement procedures and are sold as-is, where-is, often at prices below open market value.

Unlike normal property transactions, auction properties:

Do not offer warranties

Do not allow negotiation after the auction

Require buyers to accept legal and physical conditions stated in the auction announcement

Why Are Auction Properties Cheaper Than Market Price?

Auction properties are sold at discounted prices because:

Sellers are enforcing debt recovery through legal procedures

Buyers must accept risks related to property condition, access, and occupancy

There are no guarantees or post-sale negotiations

The lower price represents risk compensation, not a defect in value.

Are Auction Properties Suitable for Foreign Investors?

Auction properties can be suitable for foreign investors who understand the legal structure and ownership restrictions.

Foreign investors commonly invest by:

Purchasing through a legally structured company

Investing in eligible property types

Using auction properties for resale (Flip) or rental income

Professional legal and title checks are strongly recommended before bidding.

Is Auction Property Investment Suitable for Beginners?

Yes — if beginners start with low-risk assets.

Beginner-friendly auction properties typically:

Are vacant (no occupants)

Have no complex legal encumbrances

Are located in liquid markets (urban or suburban areas)

Properties with multiple claims, severe deterioration, or no access for inspection are not suitable for beginners.

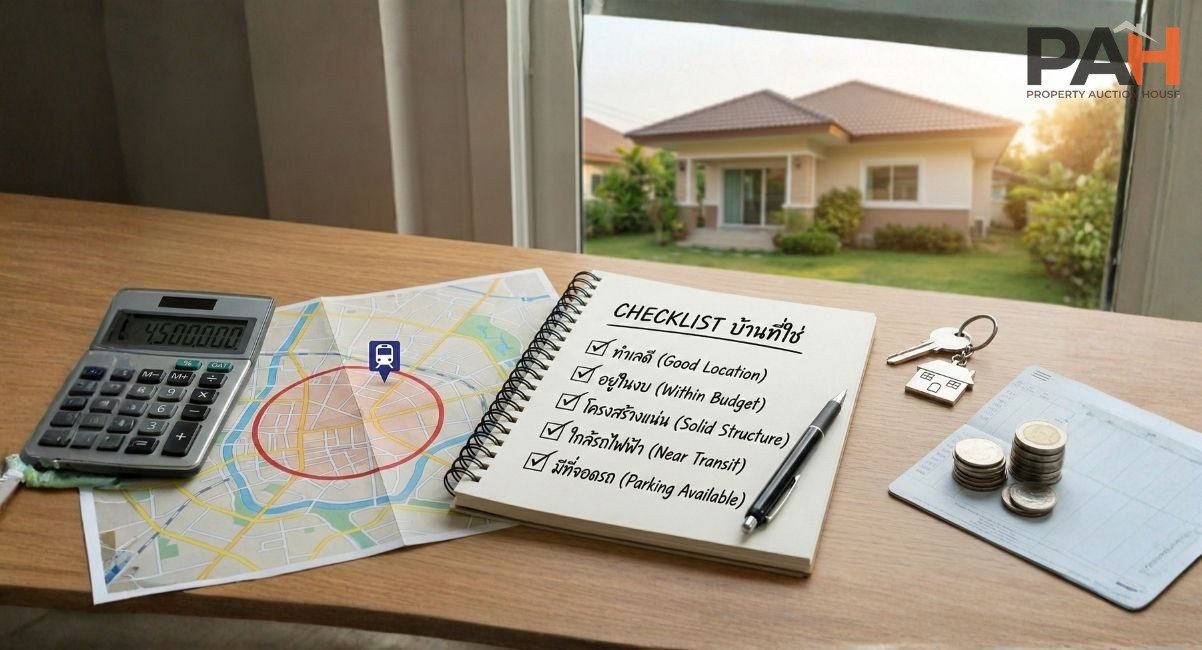

What Type of Auction Property Should Beginners Start With?

Beginner investors should focus on:

Standard houses or townhouses

Properties near main roads, business districts, or residential communities

Assets with clear resale or rental demand

These properties are easier to evaluate externally and easier to exit.

How Much Capital Is Required to Invest in Auction Property?

Capital requirements vary by location and asset type.

As a general guideline:

Provincial areas: starting from lower price ranges

Major cities: higher capital requirements

Investors should prepare an additional 20–30% buffer on top of the purchase price to cover:

Renovation costs

Legal fees

Transfer fees

Holding costs

What Is Property Flipping Using Auction Properties?

Auction property flipping means:

Buying below market value

Renovating or improving the property

Reselling for profit based on price spread

Successful flipping depends on total cost control, not just buying cheap.

Is Auction Property Flipping Profitable?

Yes — when executed correctly.

Professional investors typically apply this rule:

Total investment cost should not exceed 60–70% of the realistic resale market price

Buying too high at auction often eliminates profit, even after renovation.

How Much Renovation Budget Should Be Reserved?

If internal inspection is possible: 10–20%

If inspection is limited or impossible: 20–30%

Underestimating renovation costs is one of the most common reasons auction investments fail.

How Long Does It Take to Sell a Flipped Auction Property?

Typical timelines:

Good locations, market pricing: 3–6 months

Secondary locations or overpriced assets: 6–12 months

Holding time must be included as a financial cost in the investment plan.

Are Auction Properties Suitable for Rental Investment?

Auction properties can generate strong rental returns if:

Acquired significantly below market value

Rental income covers ownership, maintenance, and vacancy risk

They are not suitable if:

Rental demand is weak

Purchase price is too high relative to achievable rent

What Is a Good Rental Yield for Auction Properties?

General benchmarks:

Below 4%: Low attractiveness

4–6%: Acceptable

6%+: Strong rental investment

Always calculate yield using net rental income, not projected rent.

What Type of Auction Property Is Easy to Rent?

Properties that rent easily usually:

Are close to workplaces, universities, hospitals, or transport hubs

Offer practical layouts and livable conditions

Avoid over-renovation that increases rent beyond market acceptance

Tenants prioritize comfort and price over luxury.

Common Mistakes Made by Auction Property Investors

Common mistakes include:

Focusing only on auction price, ignoring total cost

Entering auctions without a maximum bid limit

Underestimating selling or rental timelines

Disciplined investors who control budgets and avoid emotional bidding tend to succeed long term.

Final Advice: How to Invest in Auction Property Safely

Auction property investment is not gambling — it is a system-driven strategy.

Successful investors:

Understand auction announcements

Assess legal and physical risks

Calculate full investment costs

Set a strict maximum bid before auction day

When done properly, auction property can be a powerful and sustainable investment tool.