Build a Smart Home Selection Checklist

Choose Wisely for Long-Term Value and Livability

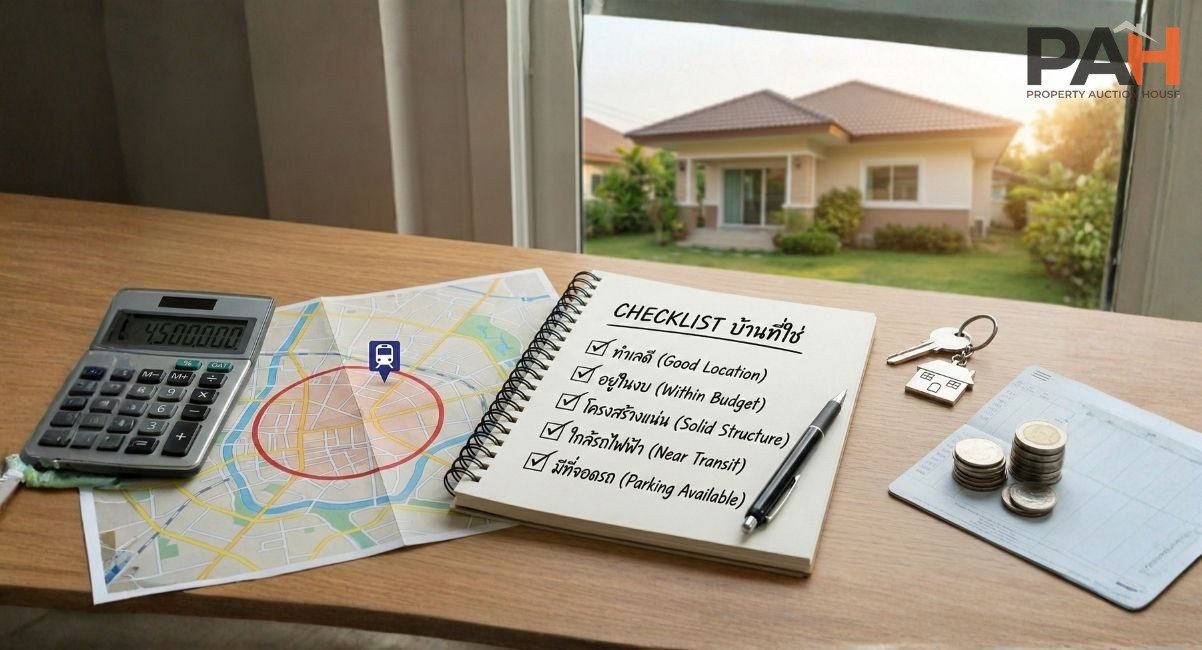

A “dream home” is not defined by size or appearance alone, but by value, practicality, and future potential. After assessing affordability, the next step is creating a clear home selection checklist.

Key Factors to Consider

Location comes first

Close to work, schools, and daily amenities

Easy transportation

Strong potential for future value appreciation

Define your needs clearly

Size and layout

Number of bedrooms, bathrooms, parking spaces

Living environment and facilities

A valuable home should be livable and investable

Potential for rental income

Resale demand in the future

New Homes vs Second-Hand Homes

New Homes

Modern design, new materials

Higher prices, often farther from city centers

Second-Hand Homes

Prime locations, established infrastructure

Lower prices but may require renovation

Inspect Second-Hand Homes in 3 Key Areas

Exterior condition

Internal systems

Structural integrity

True property cost = purchase price + renovation cost

FAQ

Q1: What should be the first factor when choosing a home?

A: Location should come first, as it cannot be changed and directly affects livability, long-term value, and resale potential.

Q2: Which is more cost-effective, a new home or a second-hand home?

A: There is no single answer. New homes offer convenience and modern materials, while second-hand homes often provide better locations and pricing. The right choice depends on budget and objectives.

Q3: Should a valuable home be rentable or resalable?

A: Yes. Rental and resale potential reduce financial risk and provide future flexibility.

Q4: What must be inspected before buying a second-hand home?

A: Three key areas: exterior condition, internal systems, and structural integrity.

Q5: Why must renovation costs be included in the home price evaluation?

A: Because the true cost of a property is the purchase price plus renovation costs. Ignoring this leads to inaccurate budgeting.