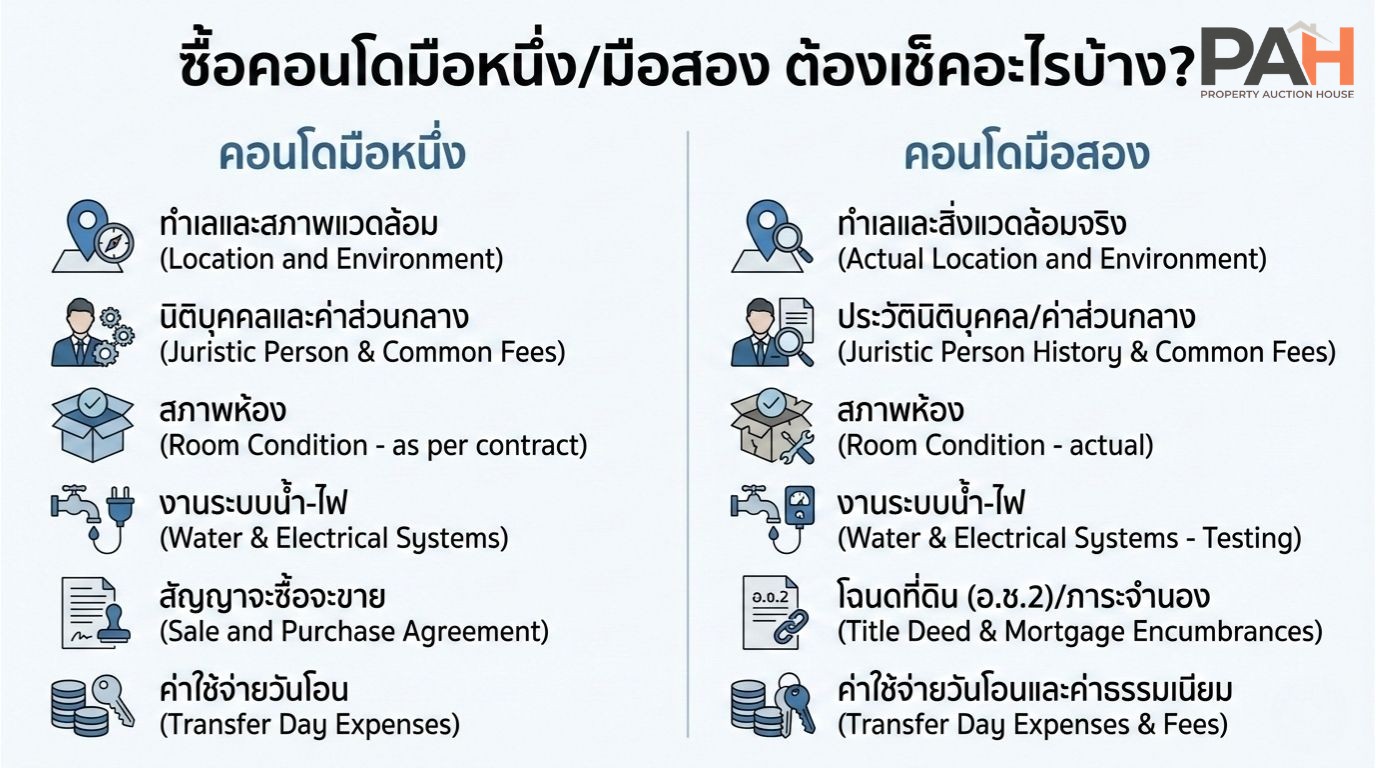

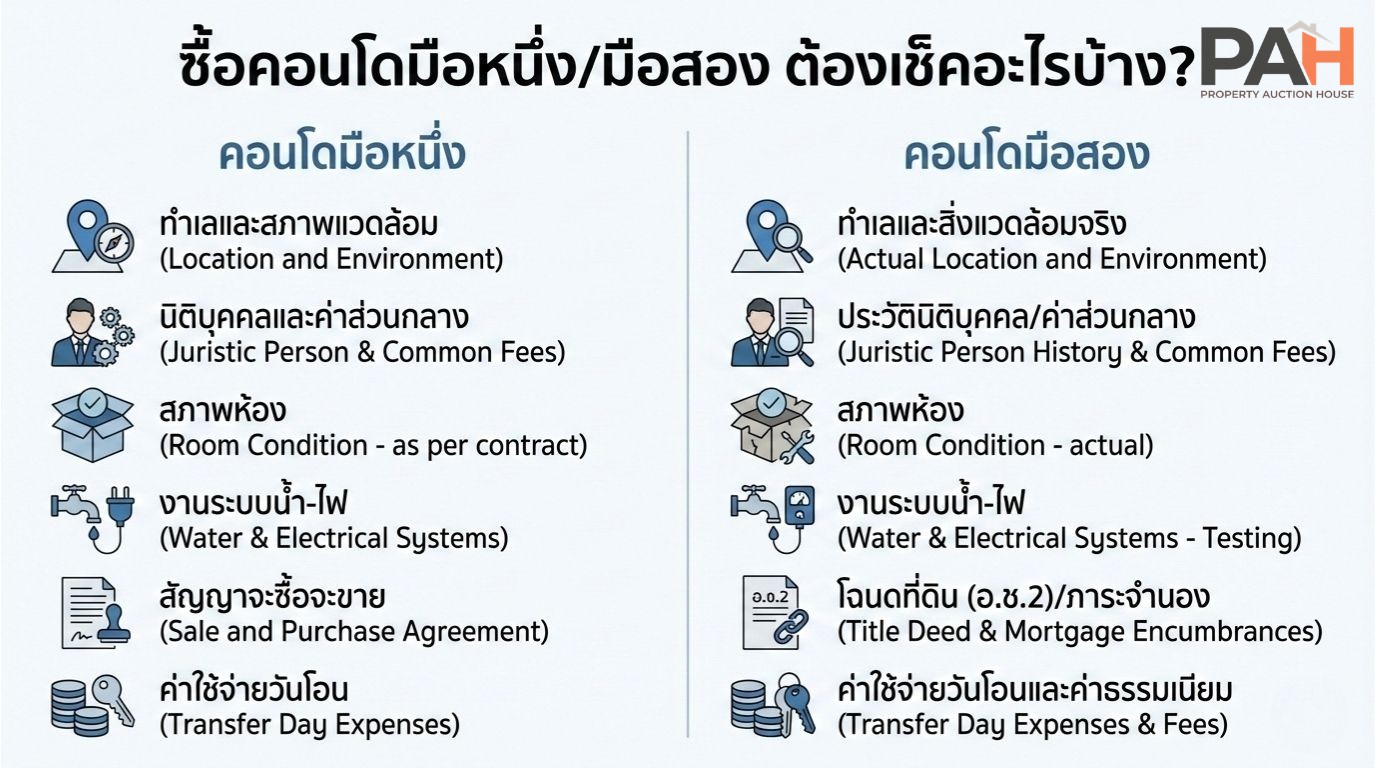

Condo Buying Checklist: What to Check Before You Buy and Before Transfer (Updated 2026)

Buying a condo is a major decision. A single mistake can lead to repair costs in the hundreds of thousands—or even millions—or legal/encumbrance issues that prevent the transfer from going through. This article compiles a detailed checklist covering every stage:

before viewing → before placing a deposit → before transfer → after handover,

so you can buy with confidence—whether it’s a brand-new condo or a resale unit.

1) Before You Start: Set Clear Goals (Live / Rent Out / Invest)

Before you start viewing units, answer these three questions. It will help you narrow down options faster and avoid getting lost.

Why are you buying? To live in / to rent out / to flip for profit

Your total all-in budget: Not just the “unit price,” but also transfer fees, mortgage registration fees, furniture, renovation costs, etc.

A location that truly fits your life: commute time to work, access to mass transit, expressways, nearby amenities, and nighttime safety

Tip: If you’re buying to rent out, start by identifying your target tenant group first (e.g., near universities, office districts, or hospitals), then choose the project.

2) Check the Surrounding Area: What People Often Overlook

A “good location” doesn’t only mean “close to the BTS/MRT.” Check these as well:

2.1 Real-life commuting

Is the walk from the station to the project manageable (day vs. night)?

Is the alley quiet/isolated? Is there sufficient street lighting?

How bad is traffic during rush hours? (Try visiting at your actual commute times.)

2.2 Nuisances (noise/smell/dust)

On a main road with frequent trucks passing

Near markets, entertainment venues, temples, schools (time-based noise)

Construction nearby or future construction plans next door

2.3 Flood risk

Review area history / ask nearby shops

Visit on a rainy day—you’ll see the clearest picture

3) Check the Project and Juristic Person: A Long-Term Quality Indicator

A great condo isn’t only about a beautiful unit—it’s about how well the building is managed by the juristic person.

3.1 Common area fees & sinking fund

Common area fee: how many THB/sq.m., and how often does it increase?

Sinking fund (one-time): how much?

Are there many residents in arrears? (This affects maintenance quality.)

3.2 Parking & elevators

Parking ratio (% of total units)

Fixed parking or first-come, first-served

Are there enough elevators? (Many units + few elevators = long waits)

3.3 Security system

Keycard access / elevator floor-locking or not

CCTV coverage of high-risk areas

Security guards and visitor registration process

3.4 Building condition & major maintenance

How old is the building?

Any recurring issues (leaks/plumbing/elevators frequently down/power drops)?

Is it close to major maintenance cycles (repainting, pump replacement, pool repair, etc.)?

4) Check the Unit Condition: Inspect Like a Pro (Before Booking/Before Transfer)

Even new condos should be inspected—systems are often where problems show up first.

4.1 Walls–ceiling–floors

Cracks, water stains, swollen ceiling panels, musty odors

Hollow/loose tiles, cracks, sinking spots

Doors/windows seal properly? Any air or water leakage?

4.2 Electrical system

Separate circuit breakers by zone?

Enough outlets—and in practical locations?

Turn on multiple lights/appliances and check for dimming, sparking, burning smells

4.3 Plumbing–bathroom–kitchen (highest-risk zone)

Turn on faucets: water pressure stable?

Pour water to test drains: fast flow? any back-odors?

Under-sink: drips, rust marks, loose pipes

Check silicone/grout: mold, gaps, corner leaks

4.4 Air-conditioning & ventilation

Is the BTU appropriate for the room size?

Dripping water / clogged drain line?

Kitchen exhaust: does it vent outside properly?

4.5 Unit position within the building

Next to elevator/trash room/machinery room/pump room = noise/odor

West-facing units get strong afternoon sun → potentially higher electricity bills

Lower floors near roads/shops = noise and dust

5) Check Documents & Encumbrances: Avoid Transfer Problems or Seizure

Especially for resale condos, verify everything before paying a deposit.

5.1 Key documents to request

Condominium title deed (Aor Chor 2 / อ.ช.2): owner name matches the seller

Clearance letter for common fees from the juristic office

Latest water/electricity receipts (to check outstanding balances)

5.2 Risks to watch for

Unit is mortgaged to a bank: plan payoff/redemption before transfer

Sale via power of attorney or inheritance: documents must be complete and clear

Be careful with “selling down-payment rights” (contract transfer unclear)

6) Check Transfer-Day Costs

Many buyers budget only for the unit price and forget transfer-day expenses—then end up short on cash.

Common costs include:

Ownership transfer fee

Mortgage registration fee (if financing)

Appraisal/bank fees

Advance common fees / sinking fund (some projects/some cases)

Tip: Before signing, agree clearly on “who pays what” and write it into the contract.

7) Sale & Purchase Agreement: What Must Be Included

7.1 Items that should be clearly stated

Price and payment terms

Transfer appointment date

Included items (“detailed list” with model/quantity/condition)

Handover conditions and defect repairs before transfer

Responsibility for transfer-day costs

7.2 “Loan not approved” conditions

If financing is rejected: is the booking/deposit refundable? how much and within how many days?

Specify required proof of loan application clearly

8) What to Do on Transfer Day (Real Checklist)

Final unit inspection before signing (take photos)

Collect keycards/keys/parking remote completely

Receive juristic documents (manuals/rules)

Take photos of water/electric meters on the handover date

9) After Handover: Do These 5 Things Immediately

Reset/change the digital lock code (if any)

Test water–electricity–AC again during the first week

Report defects within the project’s claim period

Replace filters / clean AC (especially for resale units)

Recheck for leaks around windows/bathroom after rainfall

Summary Checklist

Location: real commute / noise-smell / flood risk

Project: common fee-sinking fund / elevators-parking / security / major maintenance

Unit: leaks-musty smell / plumbing-electric / drains / AC / unit position

Documents: Aor Chor 2 / common fee clearance / mortgage encumbrance

Contract: included items / transfer-day costs / loan rejection terms

Transfer day: final inspection + collect everything

FAQ

What should I check more carefully when buying a resale condo?

Focus on three areas: (1) unit condition & repairs, (2) documents/mortgage encumbrances, and (3) common-fee clearance letter—these are the main causes of transfer problems or hidden costs.

Do I need to inspect a brand-new condo?

Yes. Especially plumbing, electrical, leak-proofing, and doors/windows—these are common defect areas and are easiest to claim under warranty.

Does a high common fee mean the condo is good?

Not always. Look for “value” and management quality: cleanliness, security, repair response time, and whether the sinking fund is sufficient.

…A great condo isn’t just a beautiful unit—it should be comfortable to live in and have clean, smooth paperwork. We hope this checklist helps you buy confidently and avoid costly mistakes.

And when you’re ready, explore the related articles below to plan even more thoroughly.