Trend Among Younger Generations: “Renting Is Better Than Buying a Home”

As consumers change the rules of the game, those who “buy to rent out” are gaining an advantage.

For many decades, “owning a home” was considered a major life milestone for Thai people. However, since the post-COVID period—especially among Gen Y and Gen Z—that picture has gradually shifted toward a new equation: living well does not necessarily require ownership. Renting is no longer merely a temporary stopgap; it is increasingly becoming a primary lifestyle choice for a growing number of urban residents.

What is particularly noteworthy is that a rise in renting among younger generations does not mean the housing market is disappearing. On the contrary, the market is changing roles—shifting from the buyer side toward the renter side. This is why, from a marketing perspective, investors who accurately read the trend and acquire properties for rental purposes may become the winners in the next cycle.

1) A Clear Signal: Rental Demand Surpasses Purchase Demand in Certain Segments

Major real estate platforms reflect consumer behavior in tangible terms. DDproperty reported that, based on visitor data from July 2024 to February 2025, 52% of users chose to rent, while 48% chose to buy—a clear sign that rental demand is no longer secondary to purchase demand.

JLL, which monitors Bangkok’s residential market on a quarterly basis, points in the same direction: the rental market and rents are accelerating, while capital values remain pressured by competition and discounts in the for-sale market. In another in-depth report, JLL assessed that economic pressure and constrained purchasing power have continued to push rental demand upward, including quantified increases in rental demand toward the end of 2025.

Key takeaway: People still need housing, but increasingly choose to rent for flexibility rather than buy for long-term commitment.

2) Why Younger Generations Believe “Renting Is More Worth It” (and Why This Trend Is Likely to Persist)

2.1 High household debt and tighter credit conditions make buying less attainable

The Bank of Thailand reported that the household debt-to-GDP ratio stood at 88.4% at the end of 2024. Although this declined from its peak in 2021, it remains high relative to many countries.

With debt levels elevated, financial institutions have tightened credit screening. Many early-career workers face the reality that they may want to buy, but cannot obtain approval, cannot borrow the full amount, or simply do not want to begin their adult lives with a long-term mortgage burden.

2.2 A slowing sales market and high unsold inventory further weaken willingness to commit

Market reporting indicates that the accumulated stock of unsold units nationwide has increased, reaching inventory values at the “multi-trillion baht” level. Meanwhile, some assessments report that the average time needed to absorb inventory (months to sell) has extended to around 57 months in certain periods.

When consumers see “large unsold supply, strong promotions, and widespread price competition,” the urgency to buy naturally declines—leading many to choose to rent and wait before committing.

2.3 “Flexibility” matters more than ownership

Mainstream Thai media consistently reflects that younger generations prioritize financial efficiency, mobility, and avoiding long-term obligations. Renting therefore becomes a practical solution in an era of rapid job changes, volatile income, and urban lifestyles where relocation is common.

2.4 Even with government stimulus, behavior does not fully revert

The government introduced measures that significantly reduced transfer and mortgage registration fees for qualifying properties, with coverage spanning 2025–2026.

In addition, the central bank temporarily eased loan-to-value (LTV) requirements to support the real estate sector. While these measures can stimulate purchase demand to some extent, the overall market still reflected a slowdown in transfers in 2025, based on REIC views cited by business media.

This indicates that the shift toward renting is not temporary; it reflects a structural adjustment in consumer behavior.

3) As More Young People Rent, Where Is the Opportunity for Investors?

From a marketer’s viewpoint: if end-user demand has not disappeared but has shifted from purchasing to renting, then housing demand is migrating into the rental market. Those who hold rental assets that closely match renter preferences are positioned to gain an advantage.

3.1 Rental income as tangible cash flow

In an environment where sale prices are pressured by promotions and competition, many investors increasingly value cash flow over immediate capital gains. This aligns with JLL’s perspective that rents are accelerating while capital values grow more modestly.

3.2 Rental yields remain attractive relative to risk assets

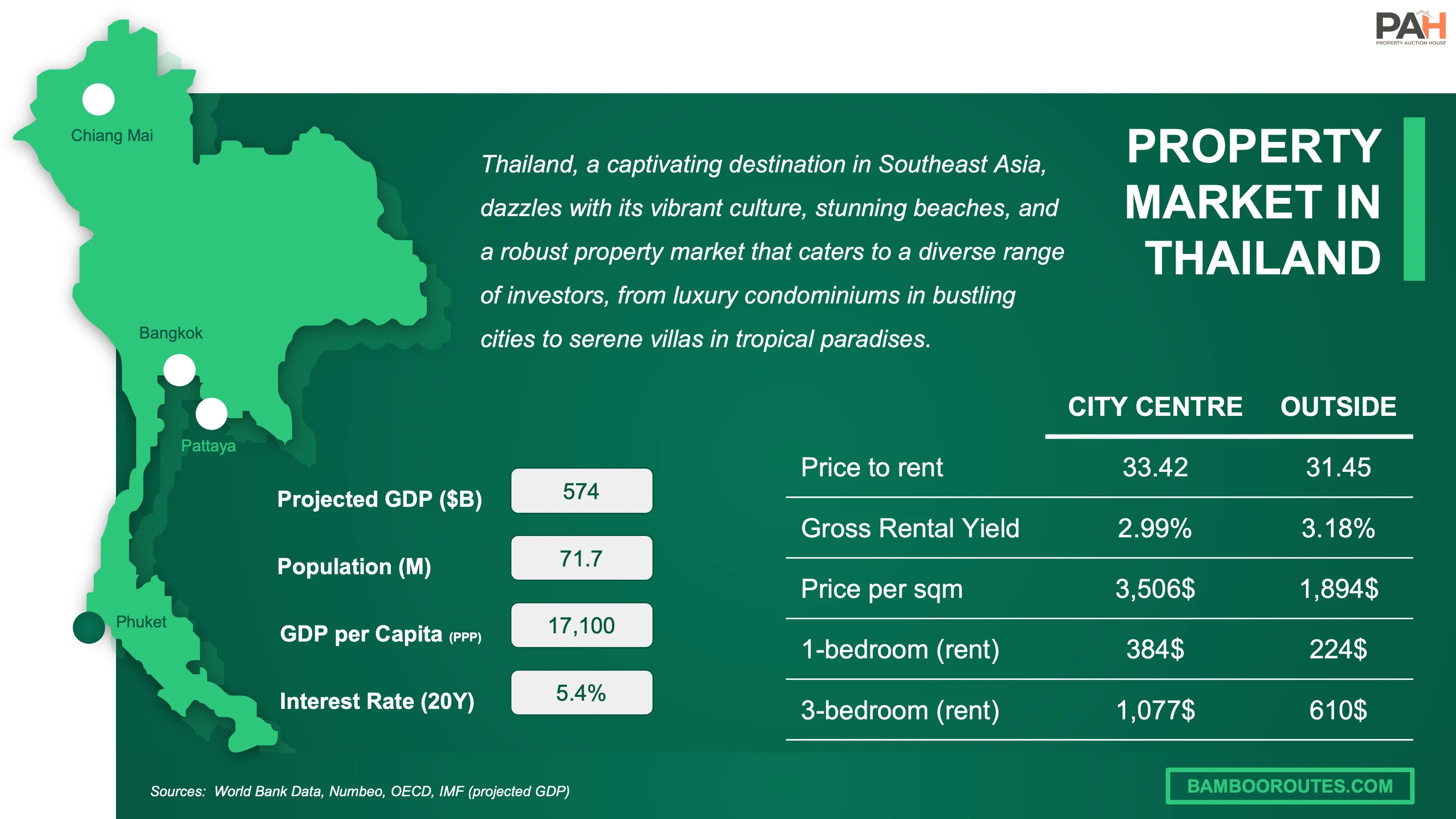

Global Property Guide’s 2025 update indicates that Bangkok’s average gross rental yield is approximately 6.04%, while the nationwide average also sits around 6%+ in certain quarters of 2025.

This implies that, if investors select the right property type and location—and manage vacancy effectively—leasing can function as a cash-generating engine supported by data.

3.3 Some surveys show a majority preference for renting among younger cohorts

Media reports citing a survey by LWS Wisdom and Solutions indicate that more than 66% of Gen Z and Gen Y prefer renting over buying.

Even if the exact figure varies by location and income, the central point remains: the urban renter base is growing, creating a strong foundation for rental investment.

4) A Marketing Framework for Winning With “Buy-to-Rent” in the Era of Younger Renters

Rental investment is not simply “buy and wait for tenants.” It is product marketing—requiring clear Positioning, Product, Price, Place, and Promotion.

Step 1: Choose a demand-led location where renters truly live their daily lives

A strong rental location is one that saves tenants time and commuting costs, such as:

Near rail transit / expressways

Near employment hubs (CBD / fringe CBD)

Near universities / hospitals / government centers

Core principle: Renters are willing to pay for time and convenience more than sheer unit size.

Step 2: Design the product to be “move-in ready” and aligned with lifestyle

Younger tenants decide quickly when the unit works immediately:

Full furnishing + essential appliances (air conditioner / refrigerator / washing machine)

Strong internet and a real work desk (hybrid/remote era)

Security systems / key card access / smart locks

Photo-friendly corners and good natural light (important in the social media era)

Step 3: Price like a marketer—not purely from a cost-based mindset

Rent should be anchored to local benchmarks plus quality differentiation. Practical tactics include:

Upgrade the unit to be one tier better than competitors at the same rent, or

Match competitor quality but add a stronger value hook (e.g., free internet / air-con cleaning)

Result: faster leasing, fewer vacant days, and higher realized returns.

Step 4: Market rental listings like lifestyle products

Younger tenants increasingly search via short videos. High-performing content includes:

30–45 second room tours

“How many minutes to BTS?” filmed in real time

Reviews of the work corner / sunset light / view

Commute cost comparisons: living far vs. living near

Step 5: Place the offer where tenants actually look—and respond fast

Property portals + rapid chat response (tenants compare multiple units)

Social media (FB Marketplace / rental groups / IG / TikTok)

Co-agent / broker networks (to speed up tenant acquisition)

The key is speed: longer vacancy directly erodes returns.

Step 6: Manage tenant experience to drive renewals (retention)

One renewal is often worth far more than finding a new tenant:

Fast repairs, fast communication

Clear, transparent contracts

Proactive outreach 45–60 days before lease expiry (fair renewal terms)

Step 7: Measure performance like a business

Key metrics:

Occupancy rate

Days vacant

Net yield (after common fees / repairs / taxes / commissions)

Annual maintenance cost

Investors who measure can optimize faster.

5) Risks That Must Be Addressed for Sustainable Investment

Even if the rental trend is clear, buy-to-rent investment carries risks that must be managed, such as:

Vacancy risk if the wrong location is chosen or rent is mispriced

Hidden costs (common fees, maintenance, furniture depreciation, tenant turnover)

Financing and interest-rate risk—especially for leveraged investors; stress-test cash flow for income gaps

Competitive pressure, particularly in areas with continued new supply

A prudent approach: prioritize properties that can be rented out in real market conditions before targeting resale gains, and maintain conservative cost assumptions.

Note: This article is prepared for informational and marketing perspectives only and does not constitute individualized investment advice.

Conclusion: Younger Generations “Rent for Flexibility,” Investors “Buy for Cash Flow”

As consumers shift from “buying to own” toward “renting to live,” the market is not shrinking—it is simply moving to a different playing field. Winners will be those who can turn real estate into a rental product with the right location, target segment, channels, and tenant experience management.

If younger generations continue to value flexibility and financial efficiency, renting will remain a sustained trend. For investors, this creates a buy-to-rent opportunity that is not merely speculation—but a repeatable income business.

References

Bank of Thailand (BoT): Financial stability reporting—household debt to GDP at end-2024 = 88.4%

Reuters: household debt-to-GDP at end-Q4/2024 = 88.4%, including total household debt figures

DDproperty: user preference split—Rent 52% vs Buy 48% (Jul 2024–Feb 2025)

JLL: Bangkok residential outlook—rental acceleration and latest market overview

JLL Q3/2025 report: quantified rental demand growth and yield direction

Global Property Guide: Bangkok rental yields ~6.04% (2025 update)

REIC (cited in business media): 2025 transfer outlook remains soft

Inventory stock and months-to-sell assessments, including the ~57 months indication

Temporary LTV easing measures supporting the real estate sector

Reduced transfer/mortgage registration fee measures and applicable timeframe

LWS survey: >66% of Gen Z and Gen Y prefer renting over buying