Thailand Legal Execution Department Property Auction Guide 2026

Property Inspection, Price Evaluation, Auction Notice Reading & Key Risks Before Bidding

Property auctions in Thailand—commonly known as legal execution auctions, foreclosed houses, or court-ordered property auctions—conducted by the

Legal Execution Department

offer buyers and investors an opportunity to purchase properties at prices below market value through a lawful and transparent process.

However, buying auction properties in Thailand requires more than just bidding the lowest price. Buyers must understand property conditions, legal notices, hidden costs, and post-auction responsibilities.

This guide covers everything you need to know—from reading auction notices and inspecting properties to cost evaluation and post-auction considerations.

What Is a Legal Execution Property Auction in Thailand?

A legal execution auction is the sale of seized properties under a court judgment or order, conducted to repay creditors. The process is legally regulated, publicly announced in advance, and open to competitive bidding.

The auction winner receives ownership strictly based on the actual condition of the property and the terms stated in the auction notice.

How to Read an Auction Notice Correctly (Most Important Step)

The auction notice is the most critical document in any Thailand property auction. It defines ownership rights, legal conditions, and buyer responsibilities.

Key Information to Check

Title deed number / unit number

Property location, size, and type

Appraised value and starting price

Auction date, time, and venue

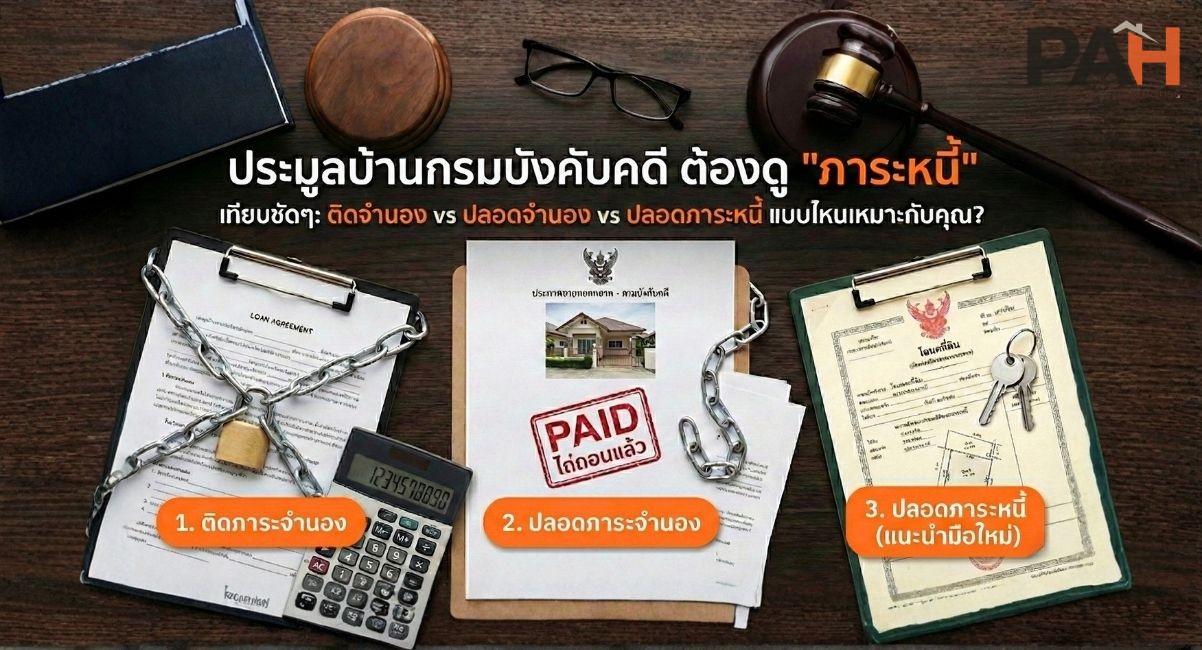

Common Legal Terms Explained

Mortgaged Property – Existing mortgage may still apply depending on sale conditions

Sold with Encumbrances – Buyer accepts existing rights or obligations

Withdrawal of Seizure – Property removed from auction

Sale Postponed – Auction postponed to a later date

No Bidders – No bids received; price may be reduced in future rounds

Buyers who read auction notices carefully significantly reduce investment risks.

Property Inspection Before Bidding

Auction properties are often cheaper—but property condition is a hidden cost.

Exterior Inspection

Structural cracks, settlement, or tilting

Roof leaks, ceiling damage, drainage issues

Doors, windows, fences, surrounding land

Public road access or easement rights

Interior Inspection (If Accessible)

Floors, walls, ceilings (moisture, mold, termites)

Electrical system and main panel

Plumbing, toilets, and water systems

Neighborhood & Location

Community safety and flood history

Accessibility and infrastructure

Future area value potential

If interior access is not possible, allocate an additional 20–30% repair buffer.

Property Price Evaluation Before Auction (True Cost Analysis)

Never evaluate auction properties by bid price alone. Always calculate total ownership cost.

Costs to Include

Expected winning bid price

Transfer fees and taxes

Repair and renovation costs

Legal or administrative expenses (if any)

Holding costs and time value

Investor Guideline

Target purchase price should be no more than 60–70% of market value.

Steps After Winning a Property Auction

After winning the bid, buyers must strictly follow legal timelines.

Payment

Pay the remaining balance within the specified period

Failure to pay may result in deposit forfeiture

Ownership Transfer

Receive official documents from the Legal Execution Department

Register ownership at the Land Office

Buyer is responsible for transfer fees and applicable taxes

Vacant Properties with Remaining Items Inside (Important Consideration)

Some auction properties may be vacant but still contain furniture or belongings.

Legally, items left inside do not automatically belong to the buyer, even after ownership transfer.

Recommended approach:

Record the condition of remaining items

Follow lawful procedures before removal

Avoid self-removal to reduce legal risk

This factor should be considered as part of time and cost planning before bidding.

Summary: Successful Property Auctions Require More Than Low Prices

Legal execution property auctions in Thailand offer strong opportunities—but only for buyers who:

Understand auction notices

Inspect properties carefully

Calculate full costs realistically

Accept legal and practical risks in advance

FAQ – Thailand Property Auction Guide

How much is the auction deposit in Thailand?

Typically 5–10% of the starting or appraised price.

Are auction properties cheaper than market value?

Yes, but renovation and hidden costs must be included.

What happens if I fail to pay after winning the auction?

Your deposit may be forfeited and bidding rights revoked.

Can I move in immediately after buying an auction property?

Only if the property is vacant and free of legal issues after ownership transfer.

Is Thailand property auction suitable for beginners?

Yes—if you study auction notices, inspect properties, and set a maximum budget.